The delayed release of the Free Application for Federal Student Aid (FAFSA) application for the 2023-2024 school year has created more of a panic among high schoolers at CVHS and across the United States during college admissions season than usual.

Since 1992, FAFSA has been the main tool used by U.S. colleges to determine how much aid they will provide to students. It is also the application that The U.S. Department of Education uses to determine who receives the Federal Pell Grant, state grants, and who qualifies for subsidized/unsubsidized loans. May 1, the deadline that the majority of colleges have set for their enrollment deposits, is just around the corner and students have yet to receive their complete financial aid packages.

Dr. Charlotte Haney, AP U.S. Government and AP Macroeconomics teacher, explained that after a fall in employment in the U.S. Department of Education during the Trump administration, the Biden administration came in with a lot of their own ambitions regarding student debt relief and easier access to federal student aid.

“All of that meant that there was a tremendous amount of burdens that were placed on the Department of Education,” Haney stated.

In order to simplify the FAFSA application process as required by Congress, the online form’s release was delayed by about three months, moving the typical release on Oct. 1 to the new release on Dec. 31. Even when the FAFSA was released that day, it was only available sporadically for thirty minutes at a time for the first two days. It was not until Jan. 8, 2024, that the form was finally made available for 24 hours a day.

Since then, both the deadlines for FAFSA application submission and processing have been postponed several times. Initially, applications were to be processed and open for corrections by the end of January. However, due to the necessity of adjusting calculations for inflation, the deadline was pushed to mid-March. As FAFSAs began to slowly process on March 15, 2024, students and parents who needed to do corrections were notified that they would have to wait until mid-April for correction opportunities to become available.

Originally, families were initially hopeful that these changes would ultimately make the process easier to navigate. Instead of having to sit through 108 questions, families would only have to answer, at most, 36 questions. With the new changes, much of the information needed to determine Pell Grant eligibility would be obtained directly from the IRS.

The new FAFSA has also replaced the traditional Expected Family Contribution (EFC) with a new Student Aid Index (SAI), which comes with a new formula meant to expand access to the Pell Grants to more students. The Department of Education also made it a point that parents without Social Security numbers would have an easier time verifying their identities.

“It was supposed to be a little bit more streamlined, easier to navigate,” said Chanae Galloway, HISD college advisor and previous member of the HISD Financial Aid Committee.

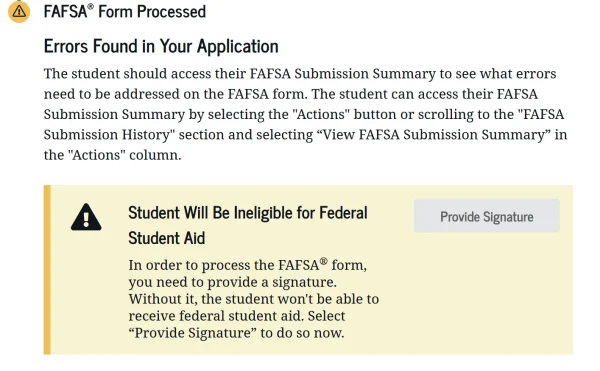

However, as families signed into their FAFSA portal, they found themselves met with a wave of technical errors. The most common were issues with identity verification, parent signatures and student signatures.

“Most issues are [with] students whose parents [are] working on their citizenship [or] they might be undocumented. Maybe they’re here on a certain visa,” said Chanae Galloway. “Those are the students who’ve been having the most issues with it. And those are typically the students who need it the most.”

Many students and parents were unable to move forward with their applications, oftentimes being forced to endlessly refresh the page in hopes that they could press the continue button. Students reported having their FAFSAs automatically submitted before they were even finished filling out all of their information.

“I was very diligent when I filled out my FAFSA, but after I submitted I got an email from the Department of Education informing me they never received my signature and I had to wait 3 months to be able to make corrections,” said a CVHS senior. “It was really scary because I’m relying a lot on the Pell Grant to be able to afford college.”

Some families who managed to fill out the entire form were greeted with error messages that prevented them from submitting their completed forms. Unlike what was promised, users without a Social Security number were unable to fully access the online FAFSA form and were forced to either wait until a workaround was found or mail in paper FAFSAs, which to this day, still have not been processed by the Department of Education.

“It’s just a lot of technological errors,” Galloway said. “And you know, [there are] things that they have to correct so we kind of are just waiting in limbo.”

Because of these unprecedented changes, college counselors and financial aid advisors, who were originally confident in their ability to navigate and troubleshoot FAFSA, have struggled to provide clear guidance to stressed students and parents. There were too many uncertainties and not enough answers from officials.

“I think financial aid is the biggest thing that prevents students from going to college,” Galloway mentioned.

These delays have had significant ripple effects on other aspects of the college application process. Scholarships, like the Rodeo Scholarship, have been forced to extend deadlines or waive FAFSA requirements completely in order to leave the door to educational funding open for students with FAFSA issues.

“Essentially, everything is getting pushed back,” Galloway said. “Around this time students traditionally would be getting their financial aid packages… but since they can’t process any aid I guarantee you that they probably won’t get packages until honestly, end of May, maybe early June and that’s pretty late.”

Colleges like the University of Texas at Austin have moved their decision dates to June 1 to accommodate the FAFSA delays but a large majority of schools such as Trinity University have stuck to the May 1 deadline. Despite not yet receiving their financial aid a lot of students are feeling pressured to commit to a college.

“Hypothetically speaking, let’s say you commit to UT but let’s say UH is giving you more money, but you don’t know that because you don’t have your packages,” said Galloway. “So, there are some students who are like, ‘Oh, I’m not sure where I’m going to commit to.’ So they’re asking those questions, but some students are just simply going to wait [until decision day].”

To address these concerns, the Department of Education is urging colleges and scholarship providers to increase their flexibility to ensure equitable opportunities for student aid that could significantly alter a student’s college decision. Now that the FAFSA has been fixed, less snafus are expected to occur for future years of college admissions.

“It’s not your fault, you didn’t do anything wrong. We’re literally just beholden to the Department of Education,” Galloway stated.