Micah Harris was facing a difficult decision after his Bar Mitzvah. The money he received was generating a small amount of interest and he could either invest it or watch as his money dwindled in worth from inflation. Motivated by his father and grandfather who has promoted investing in his household, Harris began investing in stocks.

His journey wasn’t always smooth. There were instances where he had lost money; however, Harris pulled through and was able to gain experience from his past mistakes.

“Shortly after Russia … attacked Ukraine, the US market crashed as a whole because of all the embargoes on Russia. The shares that I bought at $190 dropped as low as $128 and that’s a large drop…. I wanted to sell but … my grandfather and my father urged me not to sell and so I waited several years for it to go back up to $190 and then I sold them,” Harris described.

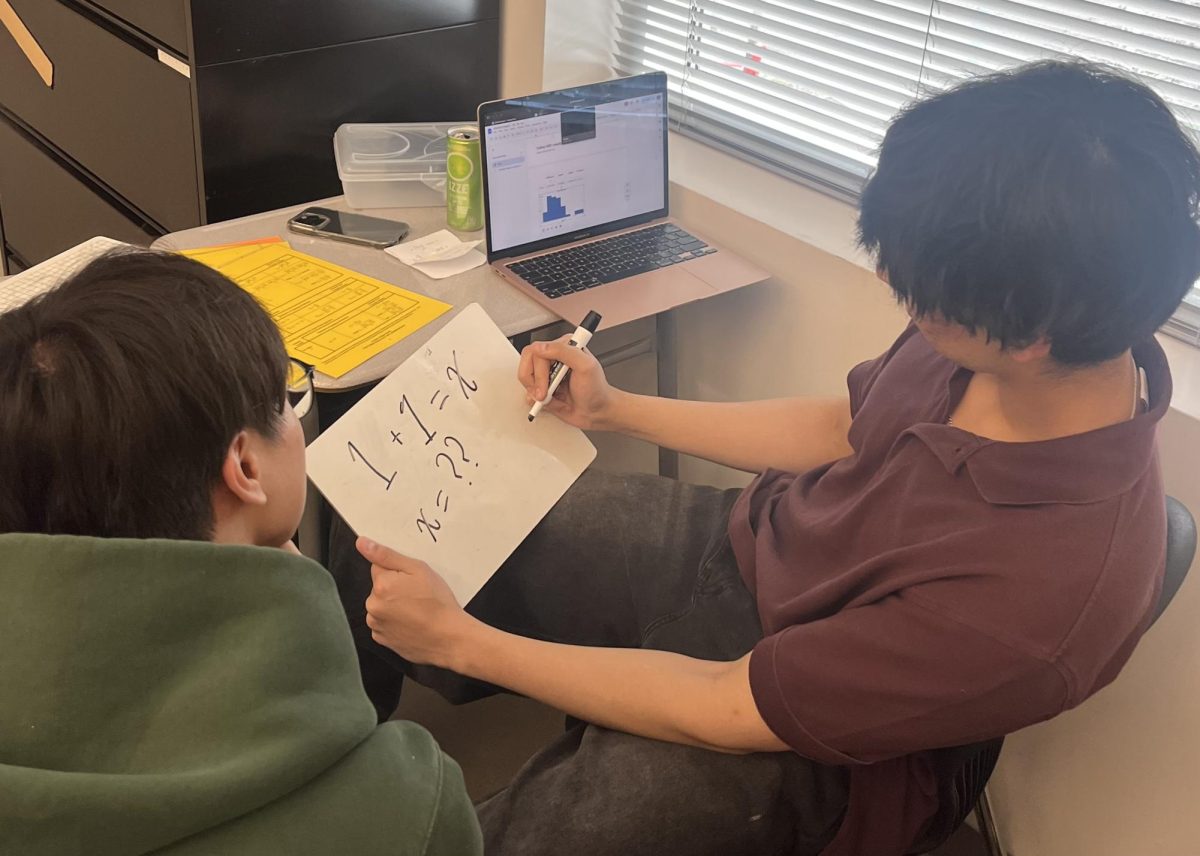

Investing has become a way for Harris to connect with others. The shared interest between Harris and his grandfather has created interesting and in-depth conversations between them where they were able to discuss their personal viewpoints on different stocks. It has also created opportunities for Harris to meet peers with similar interests. For instance, his prior participation in the Wharton Global High School Investment competition created an environment for people with similar interests to share their knowledge with each other.

“I saw different people’s ways of analyzing stocks. I was able to talk to other people as they did research about different types of stocks and equities in different sectors, so it helps me gain more exposure,” Harris said.

In the future, Harris plans on expanding his portfolio into various fields of interest such as biochemistry and real estate.

“So the breakdown of my portfolio is about 45% … is in ETFs and mutual funds that track the market. 45% of my portfolio is in tech, such as cybersecurity, Apple, [etc]. And then the rest of my 10% is in other things,” Harris explained.

Harris shares tips for anyone interested in investing:

- “Invest in what you know. So if you [know] absolutely nothing about tech; that means you shouldn’t touch it with a 10 foot pole.”

- “Pick an ETF, they basically average out all of the different things. An ETF is an exchange trade fund. Think of it as someone managing a little portfolio of stocks.”

- “Buy something that you think will do well, because you know that it will; not because people are saying that it’s going to do well.”

- “Avoid small cap companies because the bigger the company is, the more stable it is. Don’t go after the small possibility of making a lot of money all the time. Instead focus on something that you know will do well.”

- “Don’t follow the herd. The big money is in the buying and waiting, not in the buying and selling.”

- “Start now. Time is your biggest ally. Although sometimes it might take longer than others, even if you buy at the peak, you will still make more money than if you were just doing bonds or certificates of deposit or just keeping cash.”

- “You don’t have any losses until you’ve sold.”

Investing has grown to become more than just a hobby for Harris.

“Investing is a way to learn about the world. I like reading articles about the stocks that I am invested in and some that I haven’t invested in. It helps me learn about different parts of the world that I didn’t expect,” Harris ended.